Colorado Retail Delivery Fee

Learn how to set up the CO Retail Delivery Fee in Commerce7 and ShipCompliant

Who is this article for?

As of Jan 1, 2024 - Those wineries that sell in excess of $100,000 in the state of Colorado are required to remit this tax. Please check with your compliance professional if you have questions about how this may pertain to your business.

In this article:

- Setting up the Fee within Commerce7

- Setting up the Fee within ShipCompliant

- Avalara Customers

- Deleting/Disabling the Fee

Setting up the CO Retail Delivery Fee within Commerce7

Here's how to set it up:

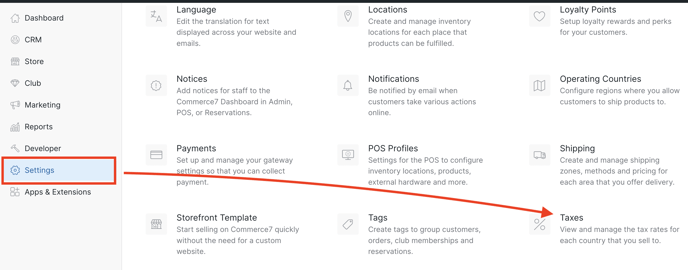

- Go to Settings > Taxes.

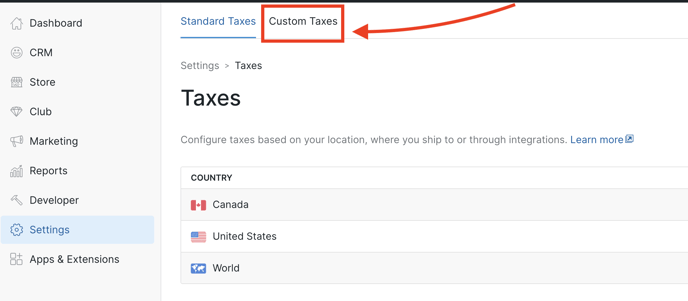

- Click on the Custom Taxes tab.

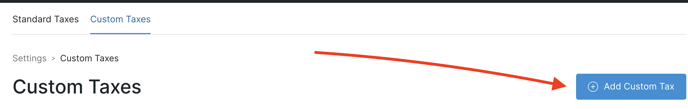

- Click on the Add Custom Tax button.

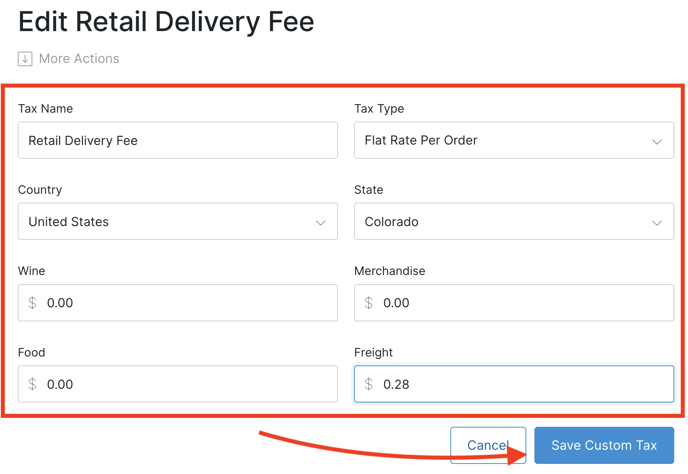

- Fill in the fields with the below settings and Save.

How It Works

If the Custom Tax exists in Commerce7, the fee of $0.29 will automatically be added to applicable Orders and display in the Order Summary.

ShipCompliant Customers

If you have a full ShipCompliant account for tax calculation and compliance-checking, then you will also need to set it up within ShipCompliant.

ShipCompliant Setup

Within your ShipCompliant account, complete the following steps:

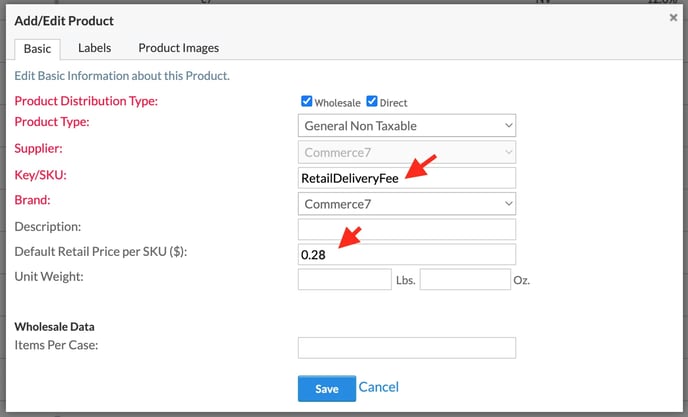

- Create a General Non-Taxable item

- The SKU must be exactly as follows: RetailDeliveryFee

- The price should be set to $0.29.

How It Works

For any order that has a Retail Delivery Fee tax assessed, Commerce7 will automatically add this RetailDeliveryFee SKU.

Note: If you pass Orders to your Fulfillment House via ShipCompliant, you will likely need to create the RetailDeliveryFee SKU within your Fulfillment House's system as well.

Avalara Customers

Setup

If you use Avalara for tax calculation, no action witin Avalara is required. Per Avalara, a $0 line item will be added to orders with the "OF400000" tax code.

Commerce7 will automatically do this for you if it sees a tax with ‘Retail Delivery Fee.’

Deleting/Disabling the Fee

If you do not want to collect the fee any longer, here's how you can disable it.

- Go to Settings > Taxes.

- Click on the Custom Taxes tab.

- Click into the CO Fee section.

- Click More Actions and choose Delete.