California Redemption Value Fee - CRV

Collection of a recycling fee on wine and spirits through the California Beverage Container Recycling Program.

To comply with updates to the California Beverage Container Recycling Program for January 1, 2024, Commerce7 will automatically calculate and apply the California Redemption Value fee to applicable orders.

Attention ShipCompliant and Avalara Users

Please note that the new fee is currently not compatible with ShipCompliant. We are currently in the process of updating this integration, but we do not have a specific timeline for completion. Once the updates are finished, we will make an announcement and include all relevant information in our documentation.

In this Article

How the CRV is calculated in Orders

How the CRV is calculated on Orders

- If an order has a California shipping address or California pickup or carryout location, a CRV fee will automatically calculated and applied to the order. (No setup is required on your end.)

- For each bottle in the order:

- For every wine bottle with less than 24 ounces, $0.05 will be added

- For every wine bottle over 24 ounces, $0.10 will be added

- Please note: The CRV amount is currently not being taxed.

- The combined fee across all items in the order will display as "CRV" in the order summary. The customer will see the fee listed on their receipt and in transaction emails.

What about On-Site Consumption and $0.00 Orders?

You have the ability to adjust the charge amount for the CRV fee if necessary for onsite pours on an Order-by-Order basis. The same goes for $0.00 Orders (like donations). If a customer plans to consume wine on-site - and also wants to purchase bottles to take with them, it is important to note that these will need to be placed as two separate orders.

Additionally, the CRV fee will only apply to Products with a Product Type of "Wine". So if you set up your tasting room samples with a Product type of "Tasting", then the CRV would not be calculated for those SKUs.

Reporting

To view the total amount charged for the CRV fee only:

- Go to Reports > Finance Reports > Tax Report.

- If the CRV fee has been charged for any orders within your selected date range, you'll see it listed as a row in the report.

- Click Email Report the top to be emailed a CSV file.

You can also see a daily summary of the CRV fee charged from the Reports > Order Reports > Closing Report.

How to see CRV per Order

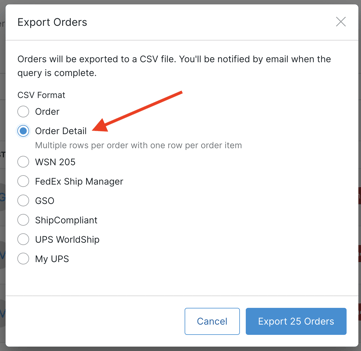

Go to Store > Orders where you can do an Order Export (with Details). This will give you SKU(s) + qty + Tax + CRV per Order.

Query to isolate CA Orders (for wineries located in CA)

Disabling the Fee

If you do not remit taxes in California, then you should not collect this tax.

- To not collect the fee, go to Settings > Taxes > Custom Taxes

- Click into the CRV section.

- Toggle the Status = Off.

- Click Save Tax.